Assessing your EMI Affordability

Deal Acres

Last Update 2 years ago

One of the biggest decisions you will make in your life will likely be to purchase a home. However, in India, the desire to be an owner rather than a tenant frequently leads to this choice. However, such important financial decisions shouldn’t be made in a hurry or under pressure. Preventing future financial trouble requires a complete awareness and planning of funds. This will help in assessing your EMI affordability.

There are a few things to think about before closing the purchase because, more often than not, purchasing property means taking out a loan. So, knowing how much one can pay is crucial before learning how to finance a property.

EMI Affordability

The most crucial aspect of house loans is the Equated Monthly Instalment or EMI. If the EMI is out of your comfortable range, buying your ideal home could turn into a nightmare. Your monthly income, the remaining number of working years, and your current responsibilities each play a role in determining your EMI Affordability.

The most crucial factor in determining whether to apply for a house loan is likely net monthly income. The ideal amount for your EMI is between 40 and 45 percent of your monthly income.

Make sure your other monthly costs and emergency money are not put at risk by the mortgage. Furthermore, even after paying off the EMI, you ought to be able to spend money without difficulty. Never overspend in the event that your salary rises in the future. You always have the choice to pre-pay the loan if your income rises in the following years.

The stage of your career when you apply for a loan is also very important. For instance, if you want to get a home loan early in your career, you might be able to get a bigger amount than if you wait till later. Because it affects your savings and retirement plans, it is important to consider when in your career you decide to take out a loan. Additionally, if your career is reaching its end, many banks are reluctant to grant you a loan.

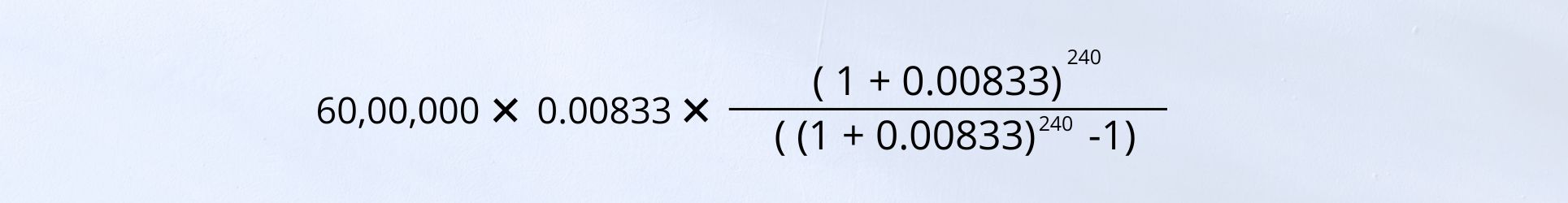

If you borrow Rs = 60,00,000 from the bank at 10% annual interest for a period of 20 years (240 months)

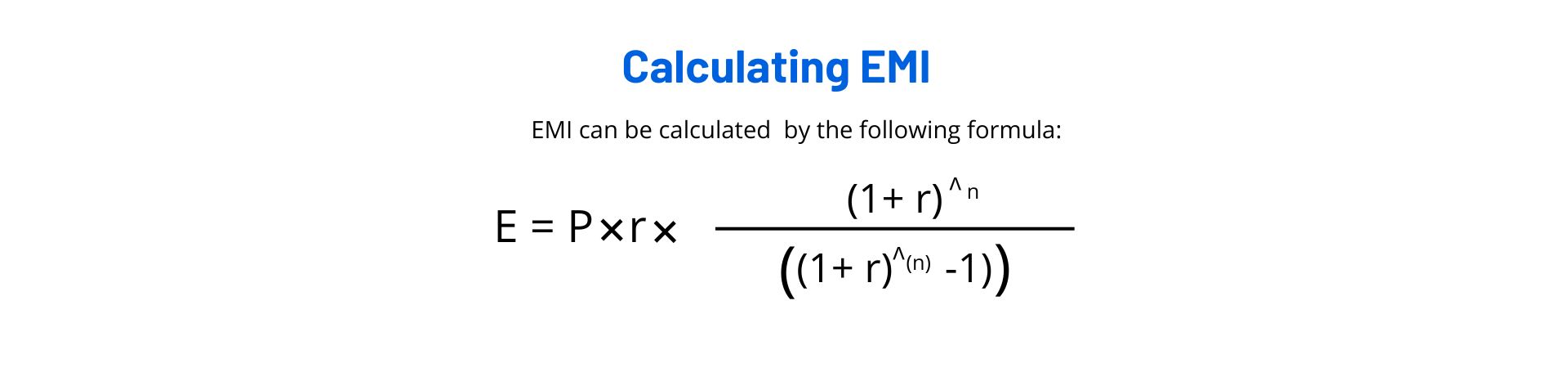

E = EMI

P = Principal loan Account

r = Rate of interest calculated on a monthly basis. [r-Rate of annual interest/12/100]

n = Loan tenure (number of months)

Determining your finances, second down payment

The entire cost of the house you want to buy is not financed by the bank. Therefore, it is crucial to determine how much you can afford to spend as a down payment out of your own pocket after you are aware of your EMI affordability. As banks do not approve 100% loans, you often need to put down at least 20–25 percent of the home’s entire cost. You must therefore be very certain of your savings.

Additionally, you need to determine whether you qualify for the amount you want from a home loan. If the amount you need and the amount you qualify for differ, you will need to make arrangements for a higher down payment to lower the overall cost.

Disclaimer: The opinions shown above are mainly for informational reasons and are based on market research. Deal Acres is not responsible for any actions made as a result of relying on the provided material and makes no representations as to its accuracy, completeness, or reliability.