How to Calculate ROI on Your Property?

Deal Acres

Last Update vor 2 Jahren

When you decide to sell your property, you want to know how much money you will make. In a technical sense, you are discussing calculating the Return on Investment (ROI). After accounting for all of the costs involved, it is utilized to determine the percentage gain from an investment (in your example, a piece of property).

You must calculate the return on investment (ROI) from the sale of your property in order to make an informed selling decision. This metric can assist you in determining whether now is a good time to sell, setting a price for your home, comparing the various offers made by buyers and most important, is to determine whether you will earn money from the sale.

These are some of the major costs involved that you should be aware of when calculating the ROI on your property:

Cost of Acquisition

These are the expenses you incurred when you bought the house you’re trying to sell.

Cost of the property – This is what you would have paid the seller for the subject property.

When you bought the property, you would have paid stamp duty and registration fees to the state’s Registration and Stamp Department.

Brokerage - This is the fee you would have given your broker when you first bought the property as compensation for his or her services. If you hadn’t used a broker, you might not have to worry about this expense.

Home loan interest component – If an institutionalized bank had financed your property, you would have paid a sizeable sum more in interest than the loan value.

Operational Costs

These are the expenses that occurred when you are the property’s owner.

If your property is an apartment in a housing society, you must have been paying maintenance fees to that housing organization.

Property taxes – As a property owner, you must pay this tax to the relevant municipal corporation for the maintenance of your neighborhood’s public services and infrastructure, including water, power, roads, and so forth.

Charges for repairs and renovations are included here, including any costs incurred for tasks like remodeling the kitchen, updating the bathroom’s plumbing, painting the house, etc.

Selling Expenses

These are the expenses you might have while selling your home.

Brokerage: The fee you will now be required to pay your broker for his or her assistance in selling your property.

Advertisement: Costs associated with placing ads in newspapers or paying for a premium package on an online site for real estate listings. This could make up a sizable portion of the costs associated with selling your house.

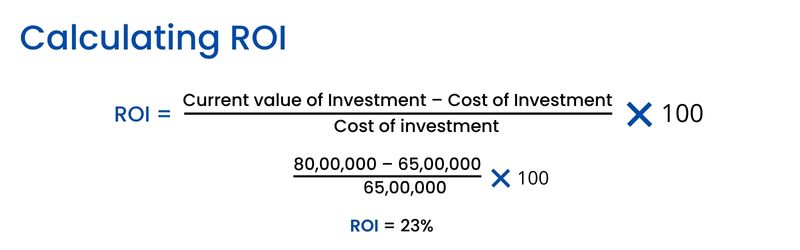

Now that we know the various costs involved, let us begin to understand the calculation of ROI through a straightforward example.

Example 1

On November 1, 2019, you purchased a property in Gurgaon, Haryana, for Rs 65 lakh. Now, on November 1, 2020, you decide to offer it for sale at Rs 80 lakh.

For the sake of simplicity, we are not factoring in any other costs that you probably incurred in this transaction.

Your estimated Return on Investment (ROI) from selling your property will be percent. Another way of viewing it would be – on an investment of Rs 60 lakh – you earned returns of Rs 20 lakh. These returns shall be in addition to your original investment cost of Rs 60 lakh.

In case you get price bids for your property from five buyers – calculate the ROI for each buyer to check the attractiveness of the offer. Input the price they are offering in the ‘current value of investment’ variable and calculate the ROI in the same manner.

Let us now look at a more complex example.

Example 2

On November 1, 2019, you purchased a property in Gurgaon, Haryana for Rs 65 lakh. You did not take a loan to purchase this property. However, there are other cost components involved, such as maintenance charges, remodeling charges, and brokerage charges (for buying the property and now, for selling the property). On November 1, 2020, you decide to offer it for sale at Rs 80 lakh.

Your estimated Return on Investment (ROI) from selling your property will be 14.13 percent. Another way of viewing it would be – on an investment of Rs 65 lakh – you will earn returns of nearly Rs 9.19 lakh. This will be in addition to your original investment cost of Rs 65 lakh.

- Maintenance charges = Rs 3,000 per month = Rs 36,000 (for one years)

- Remodeling charges (paintwork, design work in the kitchen) = Rs 4,00,000

- Brokerage (hypothetical; actual commission may vary) for first buying the property = 1 percent on Rs 65,00,000 = Rs 65,000

- Brokerage (hypothetical; actual commission may vary) for now selling the property = 1 percent on Rs 80,00,000 = Rs 80,000

Disclaimer: The opinions shown above are mainly for informational reasons and are based on market research. Deal Acres is not responsible for any actions made as a result of relying on the provided material and makes no representations as to its accuracy, completeness, or reliability.