Selling Occupied Property vs Unoccupied Property

Deal Acres

Last Update há 2 anos

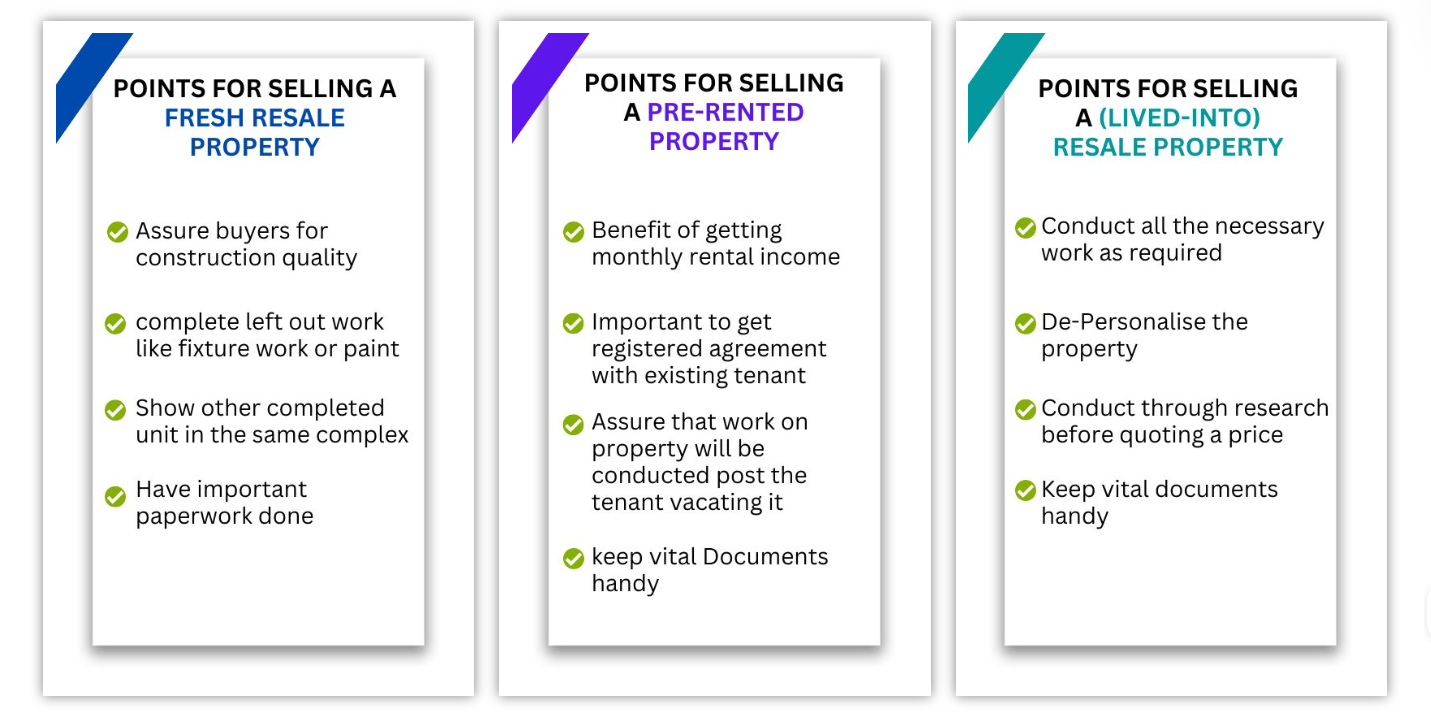

Selling Occupied Property vs Unoccupied property is Based on your property’s current status, such as whether it is a newly resold property, one that you have lived in for a while and are now looking to sell, or one that is currently rented out when you decide to sell it, you will need to adopt various selling methods.

Selling Occupied Property vs Unoccupied Property

Selling a house, you’ve lived in for a while but now wish to sell.

You may have been in your home for two to three years and now want to move or upgrade to a larger home. It is crucial in these situations to reassure the buyer of your motivation for selling (improvement, relocation, etc.), as they can be suspicious if there are any problems with the property that are forcing you to sell it so quickly.

Before inviting potential buyers to view the house, you should confirm that it is in a usable state to assure them of this. It would also be wise to paint your home because it would give it a new look. Before scheduling visits, you can also think about taking out all of your personal belongings to enable the buyer to view the home impartially.

Selling a Brand-New Resale Home

In this situation, you may have either bought a property that is still being built and now want to sell it as it is near completion, or you may have bought a brand-new, ready-to-move property but haven’t moved in yet and want to sell.

If the property is a project of a real estate developer, you can show the potential buyer the brochure of the property and any unit of a comparable configuration within the project that has already been built entirely to give them an idea of what your under-construction property will look like once it is fully built.

Additionally, it is wise to let potential purchasers know whether your house was built by a reputable builder. This can reassure them about the building quality, the chance of a timely completion (in the first scenario), and a fair resale value if the buyer wishes to sell later on for a profit.

Keep in mind the “transfer fee,” which the builder will demand if you sell your property that is still being built to someone else. When determining your profit from the deal, this sum would need to be added to your entire cost.

Selling a Rented Home

If the potential buyer is an investor in this situation, you should recognize the fact that he or she will receive a pre-leased asset with guaranteed monthly rental income, and that too without having to spend time, effort, or money looking for a tenant. While highlighting all the other beneficial aspects of your house, this should be your main selling pitch.

A “Change of User” amendment agreement between you and the buyer is required; it specifies that the landlord will change, but the renter will remain the same. The previous rent agreement between the landlord and tenant would include this paper as an annexure.

If the potential buyer is an end user, you can assure him or her that a registered rent agreement already exists with the renter and that the tenant would vacate the home when the lease time is through, allowing the buyer to move in.

Therefore, to increase the likelihood that your property will sell, remember to adapt your selling strategy to the condition of the property.

Disclaimer: The opinions shown above are mainly for informational reasons and are based on market research. Deal Acres is not responsible for any actions made as a result of relying on the provided material and makes no representations as to its accuracy, completeness, or reliability.